FactSet APAC Trading Challenge – Fall 2025

Prizes

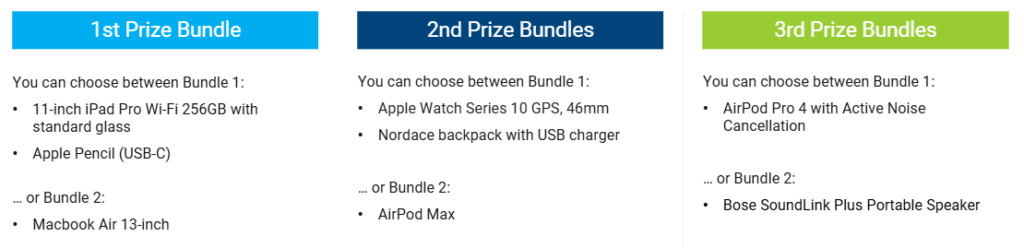

In addition to cash and technology prizes, winning teams can also enjoy:

- A formal online certificate awarded by FactSet upon passing mandatory courses

- Interview prep and career counseling from FactSet’s Recruiting Team

- A fast-track through our interview process for the fulltime Client Solutions Position or Client Solutions Summer internship

Winners will be determined based on their overall sharpe ratio , stock analysis, final presentation performance, following the rules, and timely completion of the FactSet online courses. See Official Rules Below. Click the button on the front page to register.

Scenario

Julie, 26, has just graduated from a leading flight academy in Australia. She works as a first officer for a feeder airline. Julie has recently received a gift of $50,000 USD from her grandparents as a graduation gift. She is an avid stock market buff since her college days and intends to use her banks brokerage app to build herself an aggressive portfolio.

Build an aggressive portfolio of your choice of securities from any and all of the following US and London Exchanges. Participants can also buy stocks on the London exchange. Additional US Exchanges to be offered are on the AMEX, NYSE and NASDAQ. Options trade on the CBOE exchange in Chicago.

Rules

- You have $50,000 USD to work with.

- A position limit of 10% for Equities, 5% for Mutual Funds, 5% for Options and 5 % of Crypto will be maintained as the maximum that anyone can invest in a security type.

- A diversification limit rule of 40% as the maximum that anyone can invest in an Asset type

- Asset types that are available include- APAC and US Stocks, US ETFs, US Options and Crypto currency.

- You will be graded on the Sharpe Ratio to be declared a winner.

- No day trading, short selling and or margin trading is permitted

- Participants have a maximum of 75 trades their disposal

- You must have trading activity in every month of the competition

*US Stocks and ETFs trade at real-time bid ask with a 15-minute delayed quote displayed in EDT

*US Mutual Funds trade at end of day pricing EDT

*Crypto – Real-time bid ask with a 15-minute delayed quote displayed trades 24 hours a day.

*APAC exchanges include the ASX, Bangkok, HK, Jakarta, Mumbai, NZ, Seoul, Shanghai ,Shenzhen, Taiwan, Tokyo , Vietnam, and Korea trade in their respective APAC time zones.

Eligibility, Registrations, Important Dates

- The challenge is free and open to all 2nd and 3rd year BSc students and all MSc students currently completing a degree in Business, Finance, Economics, Computer Science, Information Engineering, Mathematics, or a general passion for Finance and capital markets.

- Students may only enter the competition once with an active UNSW / Macquarie University / Western Sydney University email address. Student will needa proof of enrollment if declared a winner.

- Students may enroll as an Individual or Team with max 3 persons.

- Registration opens 9am (AET) on Monday 1st August 2025 and closes at 11:59 PM AET on Friday 14th August.

- The Competition begins at 9am (AET) on Monday 18th August 2025 and will run through 11:59 PM AET on 10th October 2025.

- All participants will be required to use the website’s Trade Notes feature to document their decisions for making their trades.

- The top 5 Teams/Individuals will be notified and will run a final presentation of their portfolio at FactSet Office with our experienced Sales and Consulting individuals.

- To be declared a winner, participants MUST

- Be an active student in UNSW / Macquarie University / Western Sydney University and registered with correspondent email address

- Have a positive portfolio return of greater than their $50,000 USD beginning cash balance provided.

- Place a minimum of 40 trades during the event.

- Have placed trades in August, September and October. If you have not placed a trade in the aforementioned months, you cannot win.

- Use the Trade Notes feature to document decisions for making trades.

- Keep at least 50% of their portfolio invested in non-cash assets for the duration of the competition.

- Complete all the mandatory FactSet Lessons by 11:59 PM AET on Friday 10th October, 2025 (examples of lessons listed below).

- Provide a valid phone number and respond if you have been declared a winner of your acceptance within 72 hours of notification of an award.

- Students must agree to supplying a photo to be made public as the organizing committee deems appropriate.

- Not completing part of the requirements will disqualify you and the organizing committee shall go in descending order to award winners.

- Stock-Trak Inc. shall be the final authority with respect to winners.

- Stock-Trak’s audit team will declare the winner 7 business days after the competition ends.

- FactSet Pacific Inc. shall be the final authority with respect to awards and distribution of prizing.

Mandatory Personal Finance & Financial Literacy Assignments

- FactSet Essentials: Core Products (Mandatory)

- FactSet Essentials: Universal Screening (Optional): This course will guide you through developing, testing, and confirming investment strategies across all databases simultaneously, which is helpful on filtering the stocks you want to focus on

- FactSet Essentials: Portfolio Analysis (Optional): This course will guide you through the usage on Portfolio Analytics tool to identify what decisions drove performance through attribution analysis, which is helpful on analyzing and explaining your portfolio returns.